Thu 11-04-2019

Hi everyone, hope you are all ok.

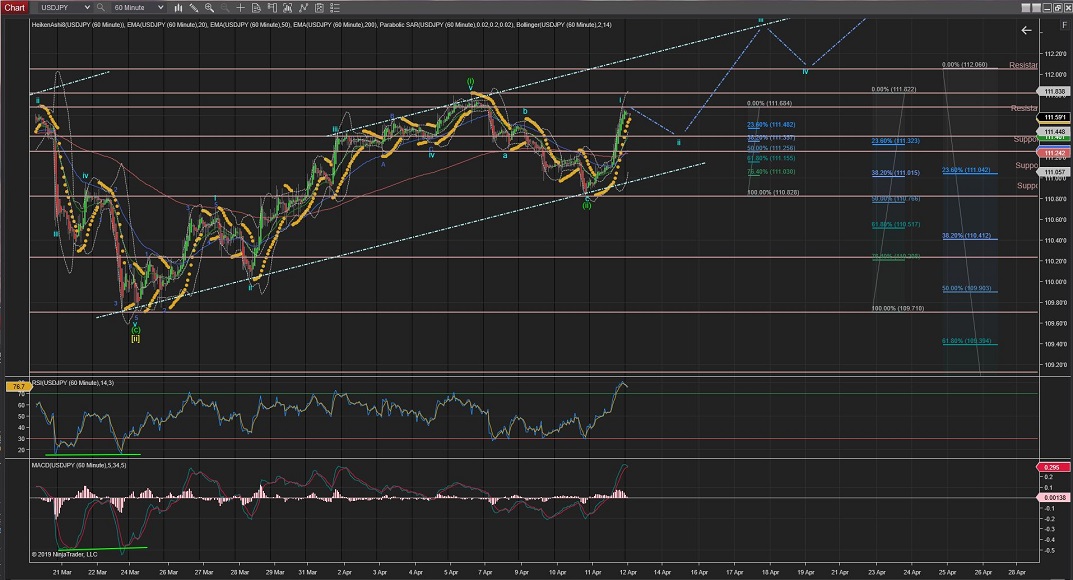

USDJPY

USDJPY after Wave (ii) correction completed almost at the %50Fib Retracement of Wave (i) it developed a large impulsive wave which suggest to be Wave i of Wave (iii).

At the same time the 4Hour Chart shows a potential Head & Shoulder formation with the highest of Wave (i) being the neckline.

The price stopped at this neckline should develop a Wave ii correction, as per current count.

Once Wave ii is completed the price should raise again with impulsive waves towards the upper trend line (light-blue) to complete Wave iii (of Wave (iii)).

60Mins

4Hours

Daily

Weekly

USDCAD

USDCAD correction of Wave (ii) completed at the %76 Fib levels.

Since then it has moved up with 3 impulsive Waves up suggesting the start of Wave (iii) of Wave 3(blue).

Wave (iii) will be confirmed when it crosses the highest of Wave (i) at 1.3450 and carries the price higher.

60Mins

4Hours

Daily

USDCHF

USDCHF broke out of the triangle to the upside and it has been grinding until the third resistance up at 1.0042.

The move has shown some impulsive moves to the upside but I haven't change the current count as I still consider the move corrective in nature and there could be a final drop towards the long-term trend line.

If the price carries on upwards through the resistances in the form of 5 clear waves it will indicate that Wave c of Wave (c) of Wave [ii] has been already completed and this is the start of the series of waves for Wave [iii].

If the price drops lower again towards the lower trend (blue), the current count would still be valid for an extended Wave c.

Regardless of the starting point for the raise, on the long term, the price is bound to raise impulsively for Wave [iii] .

60Mins

4Hours

Daily

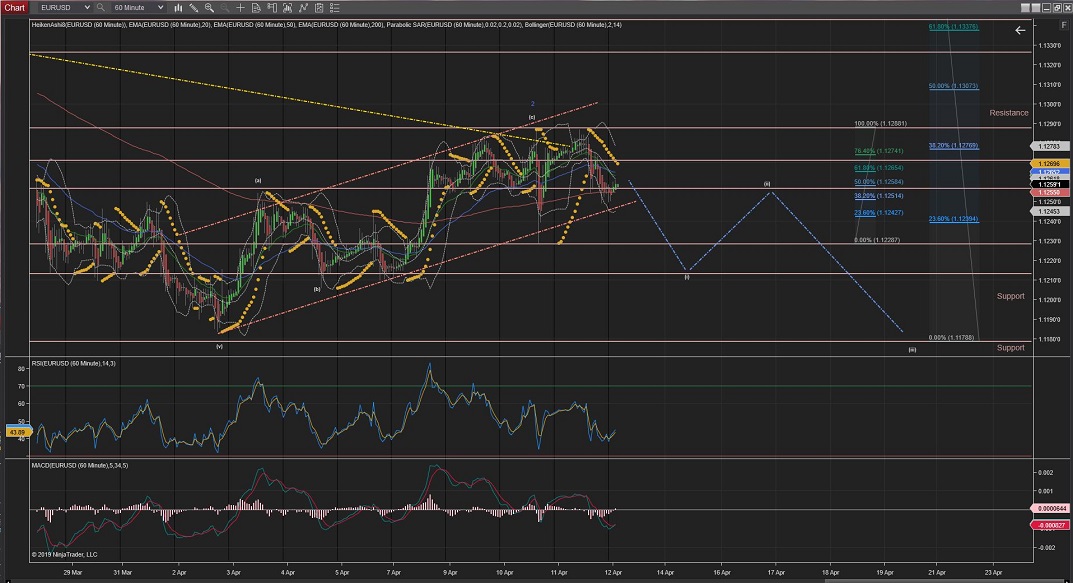

EURUSD

EURUSD after Wave 2 (blue) correction completed at just above the %38Fib retracement, Wave 3 of Wave iii had an initial impulsive wave to the downside.

The current move is showing to be the correction of the initial impulsive wave.

Further moves up from todays high at 1.1288 would imply Wave 2 is still in play for a greater retracement.

Next, as per current count, Wave 3 should continue to move down impulsively across the trend line (light-red) and support levels.

60Mins

4Hours

Daily

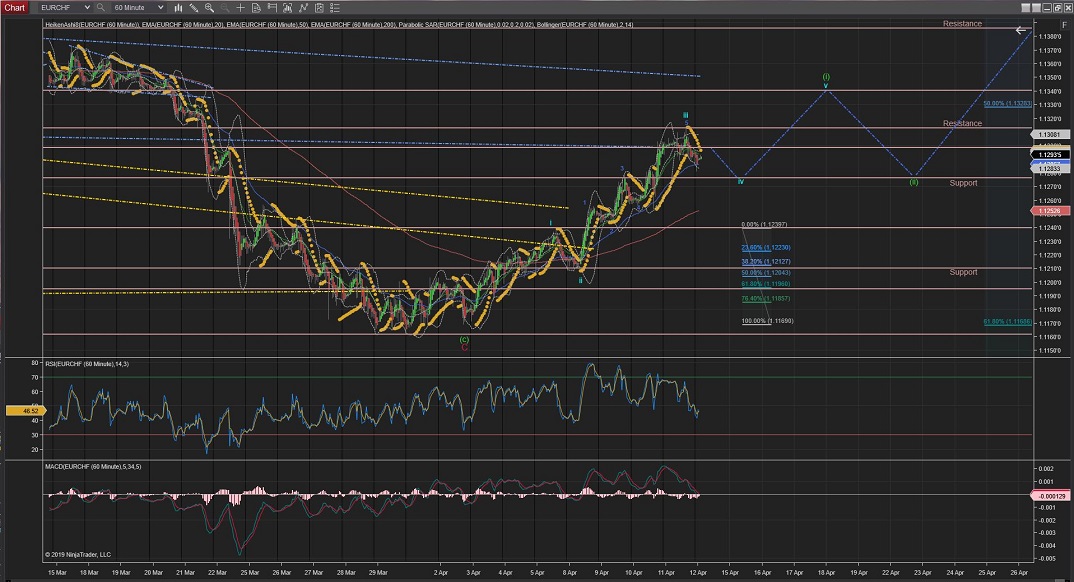

EURCHF

EURCHF Wave iii completed 5 internal waves at 1.1308 today and has started Wave iv correction towards support levels.

The first support level for Wave iv stands at the 1.1276 area and the highest of Wave i at 1.1240 should not be crosses for this count to remain valid.

Next, after Wave iv correction completes, Wave 5 should carry the price higher towards the next resistance level at the 1.1340 area to complete Wave (i).

60Mins

4Hours

Daily

EURGBP

EURGBP Wave 2 is showing a ZigZag (5,3,5) correction possibly extending further to complete at the %76 Fibonacci retracement of Wave 1.

Note if the price crosses higher than the 0Fib retracement it would trigger the alternative count of a Wave (ii) going towards the %62Fib level again or higher at the %76.

If the current count is correct, Wave 3 should continue the waves down taking the price below the lowest of Wave 1 at 0.8500.

60Mins

4Hours

Daily

Weekly

GBPUSD

GBPUSD is moving in a very undecided fashion.

Wave ii reached the %50Fib retracement of Wave i and dropped sharply.

This sharp drop suggest that Wave ii could have been completed and Wave iii is underway.

Since then the possible Wave iii down seems to be going through its internal Wave (ii) correction and, once completed, should carry on with the impulsive waves downwards.

(Notice that if the price crosses the red trend it would suggest that Wave ii correction is still in play and price might raise towards resistances at the 1.3300 area again)

As per current count, Wave iii will be confirm when/if the price crosses the lowest of Wave (i) at the 1.3000 level area.

60Mins

4Hours

Daily

AUDUSD

Daily & 4Hour Charts:

AUDUSD 4Hour Chart is showing the price raising from the neckline of a clear Head & Shoulders pattern which is suggesting Wave (iii) could be finally making its way up.

Still not out of the woods yet, so further moves lower than this neckline would trigger the alternative count for an extended Wave [ii] going towards the %76 levels of support, although it is still possible an extended Wave [v] or even a further extended Wave 5, with not much resistance levels to stop the move down (best seen in the 4Hour and Daily charts) .

Hourly Chart:

Next, Wave iii should continue the remaining of its 5 internal waves up, possibly to the next resistance level around the 0.7200 area.

From there, Wave 4 should do another correction in price before Wave 5 takes the price higher to complete Wave iii.

60Mins

4Hours

Daily

Weekly

All the best for everyone.

Andres