Fri 16-07-2021

Hi everyone, hope you are all great.

So... Let's get into it...

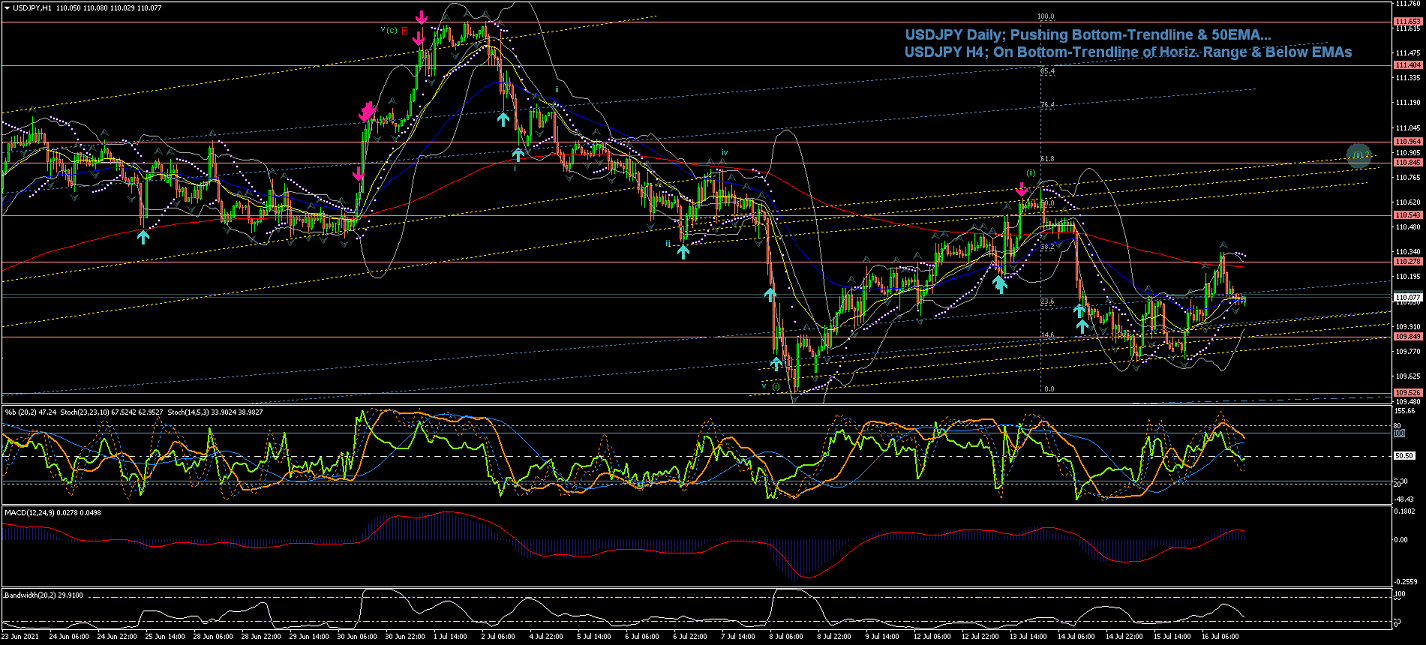

USDJPY

Weekly Chart is showing Wave (1) could be completed now that the price has crossed the upper long-term trendline...

A rise from the lower trend line, after the this long-term correction, under the current count,

suggests the beginning of the start of Wave (1) of a long-term raise.

(Price re-entering the long-term Range and subsequent drop across the %50 retracement would favor Alternate #1 count for an extended Wave (C) of Wave [B] correction towards the %62)

Daily Chart is been showing Wave (1) should be completed as the price has now crossed the EMAs impulsively after nearly a year... let's see the price reaction to the long-term Trendline (blue)...

At first glance Wave (2) has already hit the %38 retracement of Wave (1)... so could be completed, as the Alternate count suggests (circled))...

The preferred count indicates that the move could be just its internal Waves A(red) completed and B(red) showing exhaustion signs...

After Wave B(red) confirms to be completed, Wave C(red) should move towards the 200EMA and possibly %50 or %62 retracement areas...

4Hour Chart is showing the corrective Wave (2) completing its internal Wave A(red) below all EMAs (with 5 waves)...

suggesting a Zig-Zag pattern ahead (5-3-5)...

Once Wave B(red) confirms to be completed (i.e. breaking out of the Horizontal Range(blue) to the downside), Wave C(red) should be then developing in the form of 5 waves down... where impulsive Wave (i) could have just be completed... and now developing or completing Wave (ii)...

(Wave (iii) would be confirm on the Range(blue) breakout to the downside...)

60Min Chart shows a close up of the mentioned Wave B(red) of Wave (2) possibly completed above the top Trendline of the current Range (blue)...

Since then the price dropped to continue with Wave C(red) towards the lower Trendline...

...with the latest impulsive price-drop hinting the potential of 5 waves just completing Wave (i) of Wave C (red), as mentioned in the H4 analysis...

(Wave (iii) would be confirm on the Range(blue) breakout to the downside...)

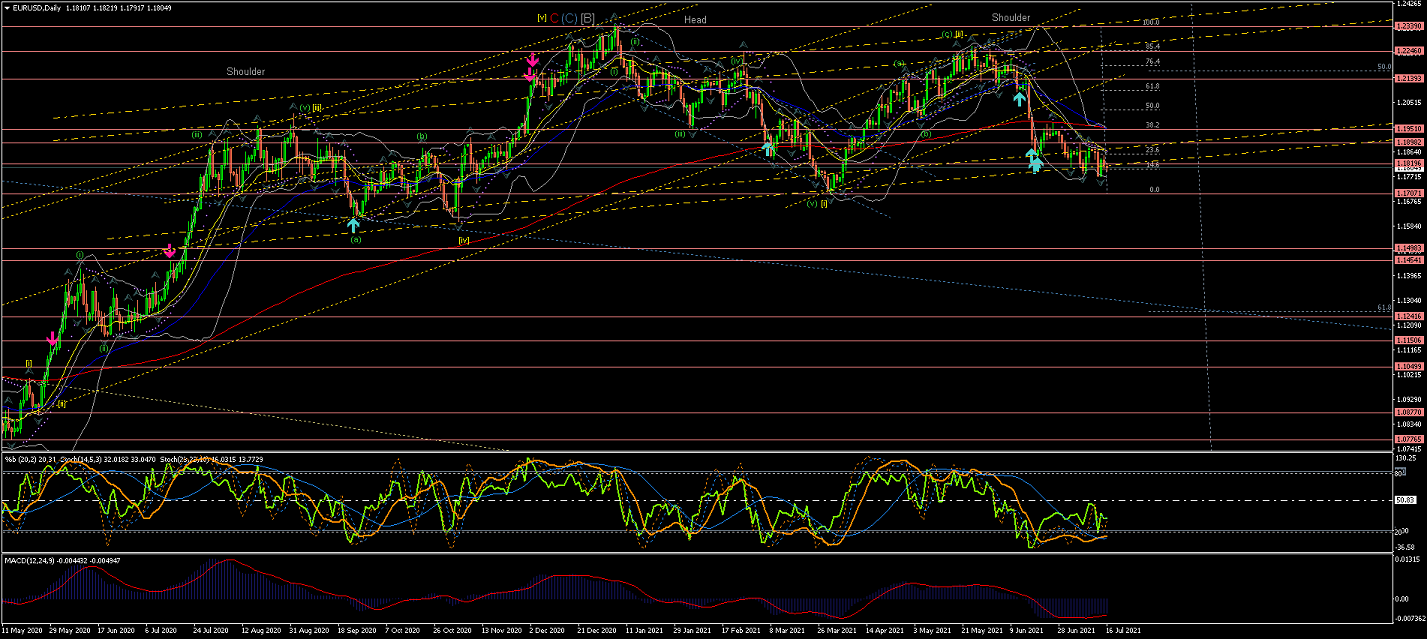

EURUSD

Weekly Chart is showing an extended Wave C(red) of Wave (C) of Wave [B] now most likely completed...

And showing signs of the price reverting into a down Trend as it headed down impulsively towards the EMAs,

although it has bounced at them causing a sharp corrective Wave [ii], as the current count suggests...

Notice the Alternate #2 for more extensive correction of long-term Wave [B] to have in mind...

Daily Chart is showing Wave C(red) most likely completed at the top trendline of the Trend Channel(yellow).

Since then the price has temporally crossed the 200EMA and lower Trendline for the potential of a new long-term Trend to the downside...

as Wave [i] looks completed...

And now Wave [ii] also looking completed at the %85 retracement of Wave [i]...

Wave [iii] seem to have made a strong initial impulsive move... and would be confirmed if the price crosses the lowest point of Wave [i] @1.17071...

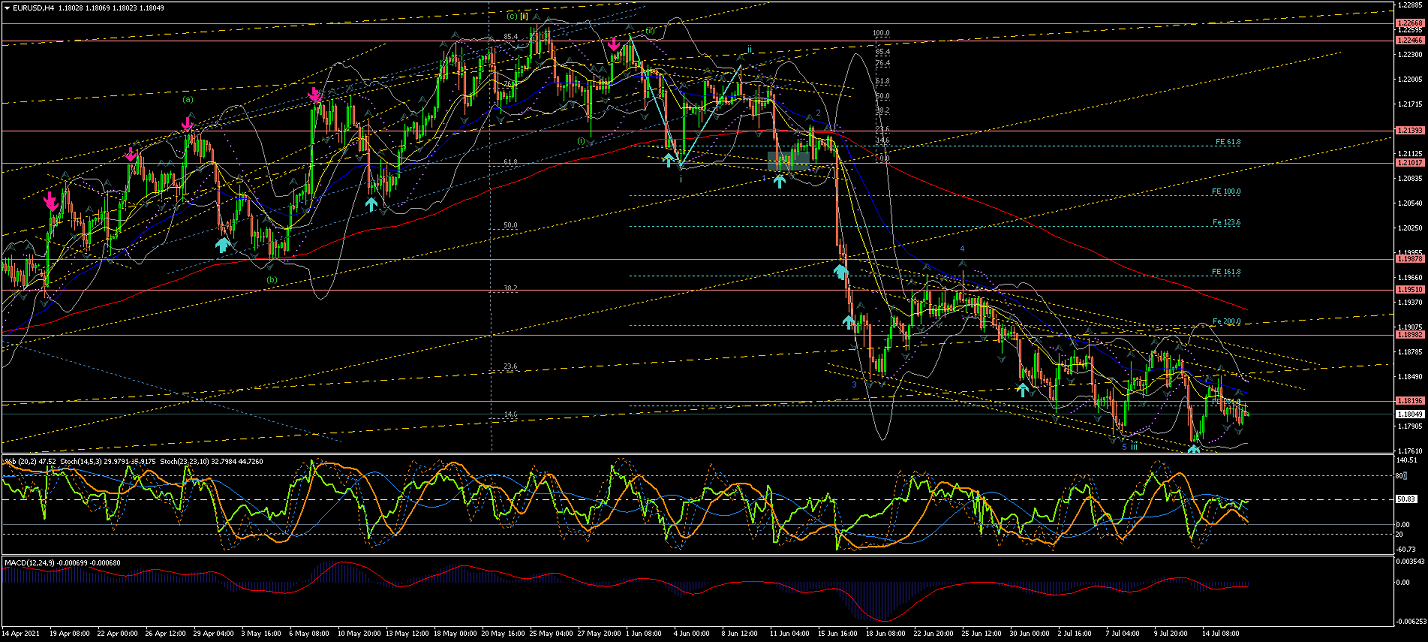

4Hour Chart is showing Waves (a), (b) and (c) of Wave [ii] now completed at the %85 retracement of Wave [i]...

...And then the price breakout of the Ascending Range (blue) and EMAs to the downside suggests the internal waves of Wave [iii]...

(Wave [iii] would be confirmed once the price breaks below the lowest of Wave [i] @ 1.17071)

60Min Chart is showing the price continuing within the current Range (yellow)...

...so far completing the initial Waves i, ii... and currently Waves 1(blue), 2(blue) 3(blue), 4(blue)...

and possibly also completed Wave 5(blue) of Wave iii (of Wave(iii) of Wave [iii])

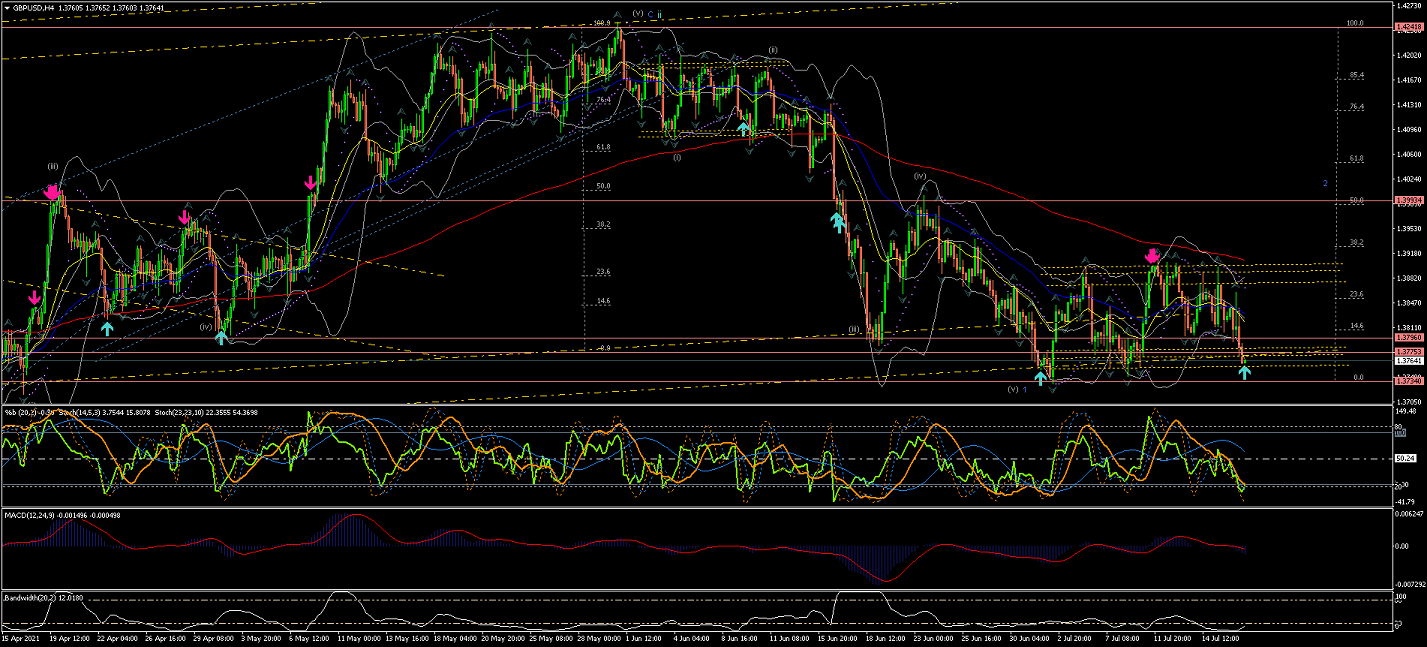

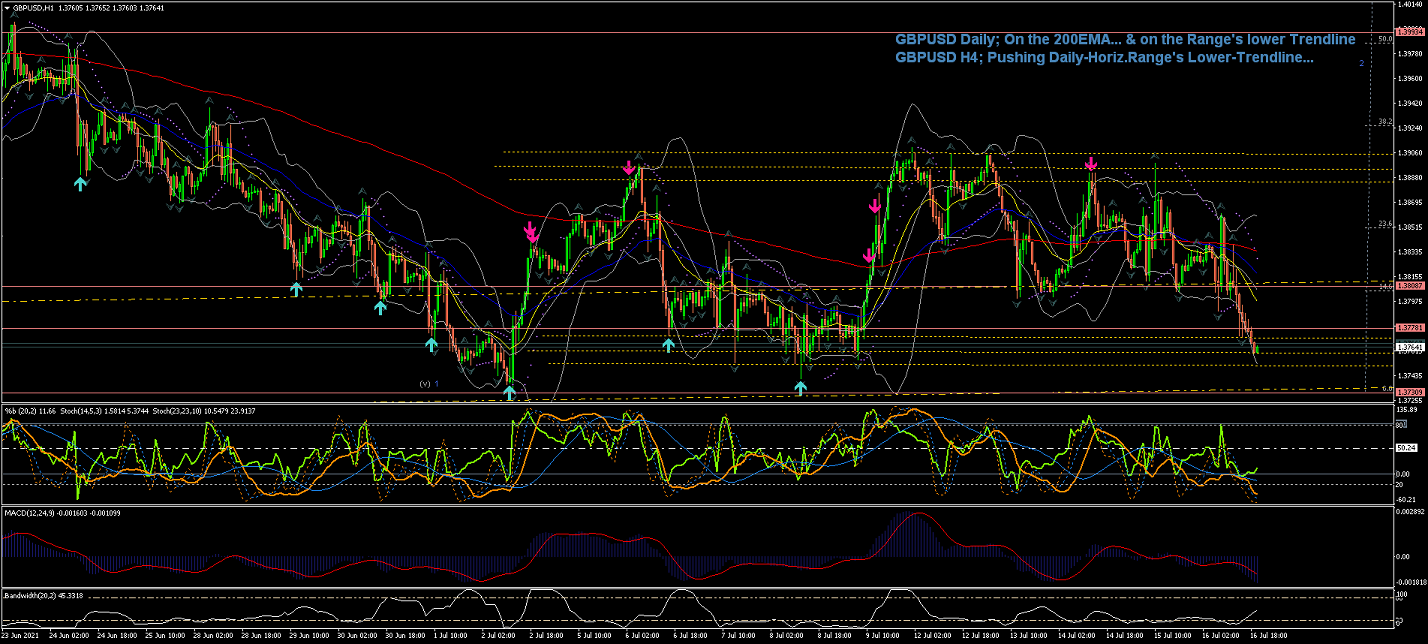

GBPUSD

Weekly chart shows an extended Wave (4) correction crossing the EMAs in a rather struggling way...

At the current resistance points the price could start coming down lower to start Wave (5), as per current count

or continue higher as Alternate #1 suggests...

Regardless of the direction, the moves still look very weak and corrective...

(Note Alternate #1 for a possible larger Wave (4) developing...).

Daily Chart is showing the Wave C(red) completing Wave (4) in what should then be a false breakout

of this long term triangle formation (blue long-term trendline).

If this is a false breakout the moves could start bringing the price down impulsively and re-entering the blue long-term trendline.

Next, if this count is correct, we should expect the price to continue the moves down impulsively for Wave (5)...

but, the price got as close as it gets to the 0 retracement and any further than the 0 would have invalidated the current count...

so for the current count to work the price still needs to complete the breakout of the new Ascending Range formation (yellow) and cross the EMAs to the downside...

4Hour Chart shows the price at few pips away from cancelling the current count,

as it nearly hit the 0 retracement of the hypothetical Wave i...

But then an impulsive move has brought the price below the EMAs for the potential start of Wave iii to the downside...

breaking current Market Structures (i.e blue Ascending Range and yellow trendline) and EMAs to the downside in an impulsive way in a series of 5-waves... that, so far, seem to have completed Wave 1(blue) of Wave iii...

60Min Chart is showing the price bounced off the lower trendline of the Horizontal Range(yellow)...

for a temporary correction of the Wave iii potential continuation to the downside, as the current count suggests...

...And, as the price just bounce-off the lower-longer-term Trendline, it should be developing Wave 2(blue) correction...

All the best for everyone and please do not hesitate to contact me if you have any questions or comments.

Andres

info@tradingwaves.org

Please be aware: that these Analysis are own opinions, not Trading advice; Trading carries a high level of risk, and may not be suitable for all investors. Before deciding to trade you should carefully consider your investment objectives, level of experience, and risk appetite.