![]()

Elliott Wave Principle; A Brief Summary

1 The Elliott Waves Pattern (Motive and Corrective)

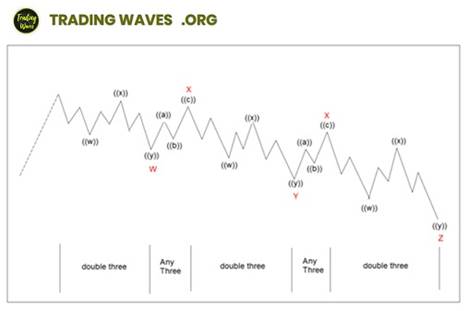

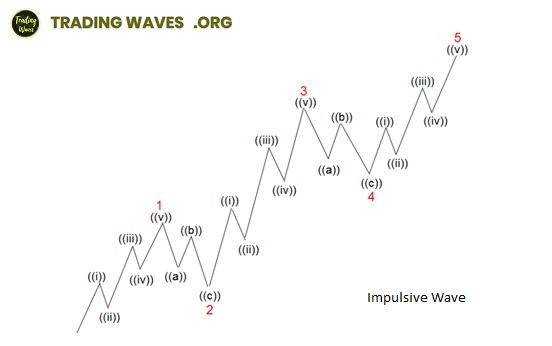

Impulses are always subdivided into a set of 5 lower-degree waves, alternating

again between motive and corrective character, so that waves 1, 3, and 5 are impulses,

and waves 2 and 4 are smaller retraces (corrections) of waves 1 and 3

The picture above shows how Waves 1, 3 and 5 are motive waves and they are

subdivided into 5 smaller degree impulses labelled as ((i)), ((ii)), ((iii)),

((iv)), and ((v)). Waves 2 and 4 are corrective waves and they are subdivided

into 3 smaller degree waves labelled as ((a)), ((b)), and ((c)). The 5 waves

move in wave 1, 2, 3, 4, and 5 make up a larger degree motive wave (1)

Corrective waves subdivide into 3 smaller-degree waves,

denoted as ABC. Corrective waves start with a counter-trend impulse (wave A), a

retrace (wave B), and another impulse (wave C). The 3 waves A, B, and C make up

a larger degree corrective wave (2)

In a bull market the dominant trend is upwards (five waves up and three down)

and, conversely, in a bear market the dominant trend is downward, so the

pattern is reversedfive waves down and three up.

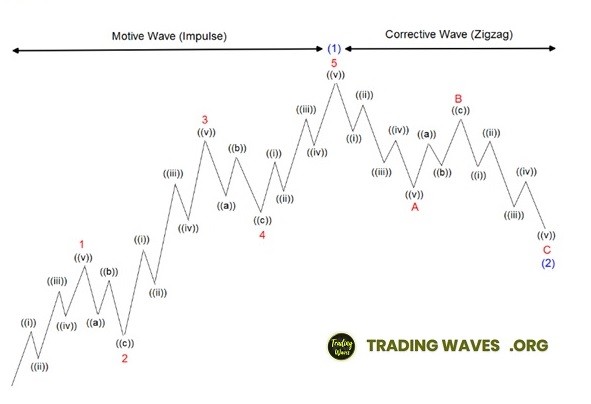

Elliott Wave degree is an Elliott Wave language to identify cycles so that

analyst can identify position of a wave within overall progress of the market:

1.1) Elliott Wave Principles Basic Rules:

Wave 2 cant retrace more than the beginning of wave 1

Wave 3 cannot be the shortest wave of the three impulse waves (namely wave 1, 3, and 5)

Wave 4 cannot overlap with the price territory of wave 1

Wave Alternation: If Wave 2 is a deep correction Wave 4 normally will be shallow, and vice versa

Wave 5 normally moves higher than Wave 3; otherwise it is called a Failed Wave 5

2 Fibonacci Retracements and Extensions

Fibonacci Retracement in technical analysis and in Elliott

Wave Principle refers to a market correction (counter trend) which is expected

to end at the areas of support or resistance denoted by key Fibonacci levels.

The market is then expected to turn and resume the trend again in the primary

direction. Following are the most common Fibonacci Retracements:

23.6%

38.2%

61.8%

76.4%

85.4%

Fibonacci Extension refers to the market moving with the

primary trend into areas of support and resistance at key Fibonacci levels

where target profit is measured. Traders use the Fibonacci Extension to

determine their target profit. Following are the most common Fibonacci

Extensions:

61.8%

100%

161.8%

200%

261.8%

323.6%

423.6%

Fibonacci Ratio is useful to measure the target of a waves move within an

Elliott Wave structure. Different waves in an Elliott Wave structure relates to

one another with Fibonacci Ratio. For example, in impulse wave:

Wave 2 is typically 50%, 61.8% or 76.4% of wave 1

Wave 3 is typically 161.8% of wave 1

Wave 4 is typically 23.6%, or 38.2% or %50 of wave 3

Wave 5 is typically 61.8%, 100%, or 123.6% of wave 1

Traders can thus use these Fibonacci Ratios to determine the

point of entry and profit target when entering into a trade.

3) Impulsive Waves

In Elliott Wave Theory, the traditional definition of an

Impulsive (or motive) wave is a 5 wave move in the same direction as the trend

of one larger degree. There are four different variations of a 5 wave move

which is considered an Impulsive wave:

- Impulse wave

- Impulse with extension

- Leading Diagonal

- Ending Diagonal

3.1) Impulsive wave:

Each Impulse wave subdivides into 5 waves in lower degree.

Fibonacci Relationships:

- Wave 2 is typically 50%, 61.8% or 76.4% of wave 1

- Wave 3 is typically 161.8% of wave 1

- Wave 4 is typically 23.6%, or 38.2% or %50 of wave 3

-

Wave 5 is typically 61.8%, 100%, or 123.6% of

wave 1

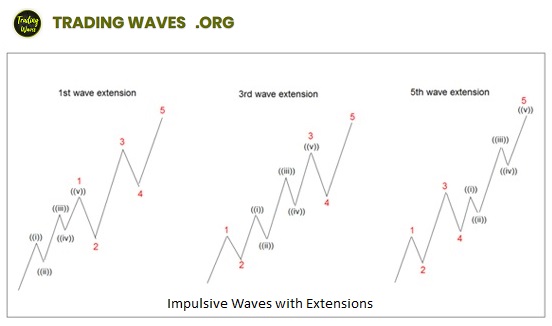

3.2) Impulsive wave with extension:

Impulses usually have an extension in one of the motive waves (either wave 1,

3, or 5)

Extensions are elongated impulses with exaggerated subdivisions

Extensions frequently occur in the third wave

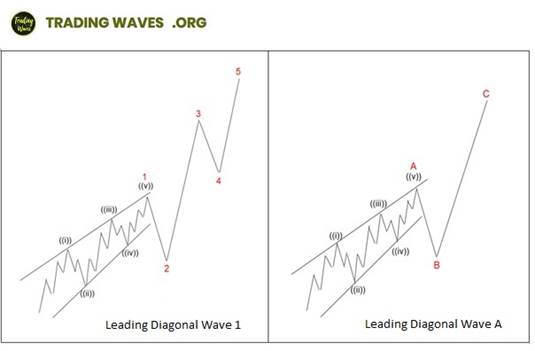

3.3) Leading Diagonal:

Special type of motive wave

which appears as subdivision of Wave 1 or Wave A in a zigzag

Leading diagonal is characterized by the Wedge formation and usually Wave 4

overlapping Wave

Diagonal Impulsive Waves are the only Impulsive Waves where Wave 4 can

overlap Wave 1

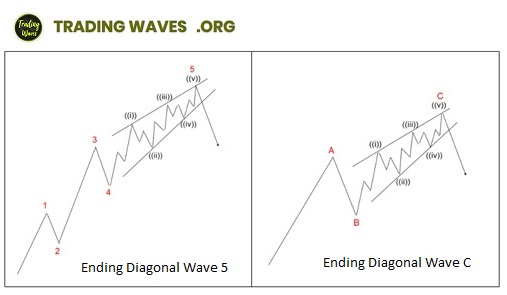

3.4) Ending Diagonal:

Special type of motive wave which appears as subdivision of Wave 5 or Wave C

in a zigzag

Leading diagonal is characterized by the Wedge formation and usually Wave 4

overlapping Wave

Diagonal Impulsive Waves are the only Impulsive Waves where Wave 4 can

overlap Wave 1

4) Corrective Waves

The classic definition of corrective waves is waves that

move against the trend of one greater degree. Corrective waves have more

variety types and are less clearly identifiable compared to impulse waves.

Hence, sometimes it can be rather difficult to identify corrective patterns

until they are completed.

When corrections come to an end, prices usually explode back in the direction

of the larger trend.

Knowing how to differentiate a corrective wave pattern from a trend wave, will

help you hold a position for longer when you are in a trend.

And it will help you enter the market at the correct time with minimised risk

levels.

There are four types of corrective patterns:

1) Zigzag (5-3-5)

2) Flat (3-3-5):

- Regular Flat

- Expanded Flat

- Running Flat

3) Triangle (3-3-3-3-3)

4) Combination:

- Double three: A combination of two

corrective patterns above

- Triple three: A combination of

three corrective patterns above

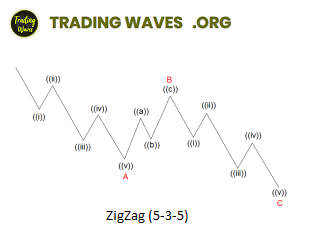

4.1) Zigzag (5-3-5):

Zigzag correction subdivides into 5-3-5 internal wave pattern

Waves A and C tend towards equality in length

Wave B tends to retrace %38 to %50 of Wave A

ZigZag correction usually appears in Wave 2

ZigZag corrections will usually target the 61.8%

retracement of the main trend move.

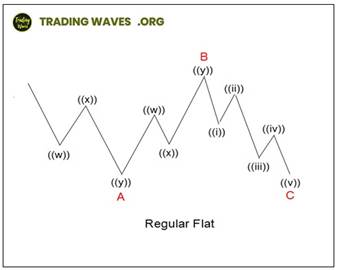

4.2) Flat (3-3-5):

A flat correction is a 3 waves corrective

move. Although the labelling is the same, flat differs from Zigzag in the

subdivision of the wave A; Whereas Zigzag is a 5-3-5 structure, Flat is a 3-3-5

structure. There are three different types of Flats: Regular, Expanded

(irregular), and Running Flats.

A Regular Flat correction subdivides into 3-3-5

internal wave pattern

-

4.2.1) Regular Flat

In general Regular Flat corrections retrace less than ZigZags

The more powerful the underlying trend, the shorter the flat correction

tends to be

Wave B terminates near the start of wave A (90% of Wave A)

Wave C generally terminates slightly beyond the end of wave A

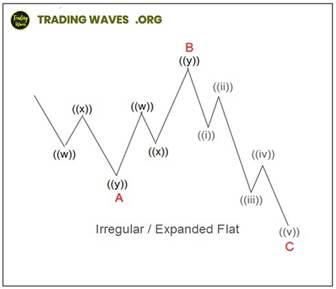

- 4.2.2) Expanded (or irregular) Flat

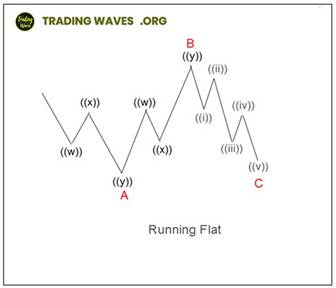

A Running Flat correction takes the same internal form

as a Regular Flat, except: 1) Wave B will travel past the beginning of Wave A

substantially (similarly to Expanded Flat) 2) But Wave C will fail to travel past the end of Wave

A So, a Running Flat will complete in the direction of

the larger trend An Expanded Flat correction takes the same internal

form as a Regular Flat, except: 1) the end of Wave B will travel past the beginning of

Wave A 2) the end of Wave C will travel past substantially

the end of Wave A

- 4.2.3) Running Flat

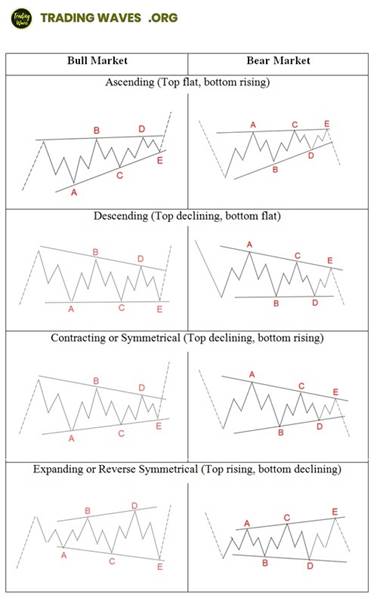

4.3) Triangle (3-3-3-3-3)

A triangle is a sideways movement that is associated with decreasing volume

and volatility

Triangles have 5 sides and each side is subdivided in 3 waves hence forming

3-3-3-3-3 structure.

Triangle waves usually occur in the position of Wave B or Wave 4 of the

larger pattern

Triangle waves usually occur in the penultimate move in the larger Wave

pattern and leads to an explosive move back into the larger trend.

There are 4 types of triangles in Elliott Wave Theory (as shown below):

1) Ascending 3) Contracting

2) Descending 4)

Expanding

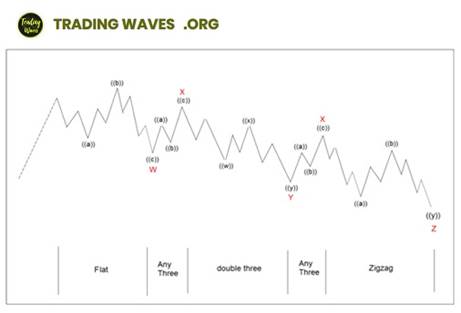

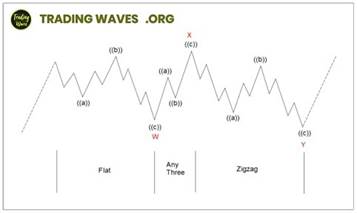

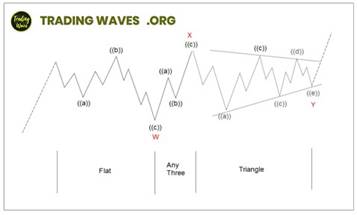

4.4) Combination:

An Elliott Wave double or triple three combination happens when simpler wave

forms stick together to form a larger structure.

For the most part, double threes and triple threes are horizontal in character.

- 4.4.1) Double three: A combination of two corrective patterns above

A combination of two corrective structures labelled as WXY

Wave W and wave Y subdivision can be zigzag, flat, double three of smaller

degree, or triple three

Wave X can be any corrective structure

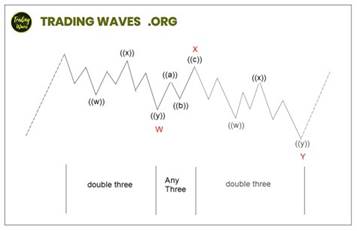

- 4..4.2) Triple three: A combination of three corrective patterns above

A combination of three corrective structures labelled as WXYXZ

Wave W, wave Y, and wave Z subdivision can be zigzag, flat, double three of

smaller degree, or triple three of smaller degree

Wave X can be any corrective structure